公积金贷款能贷多少?怎么计算?

作者:轻松保 |

发布时间:2017-07-13 |

阅读次数:2485

公积金贷款能贷多少?公积金贷款利率应该怎么计算呢?近日一位王先生咨询

轻松保小编整理了关于公积金贷款能贷多少?怎么计算?的相关信息,希望能够对您有所帮助!

公积金贷款能贷多少?

王先生提问:我要买一套37万的房子,住房公积金每月缴纳180元,已缴纳20年。工资3500元,不知道一次可贷款多少,个人能贷30万吗?

针对王先生的疑问,轻松保保险网给出了解答。

寿险,公积金贷款额度=借款人及参贷人公积金月缴存额之和÷缴存比例×12个月×贷款年限×40%。

王先生每个月缴纳180元,已缴纳20年。依照这个数据我们可以算出王先生公积金贷款的额度=180×12×20÷(180÷3500)×12×20×40%=213284元。所以王先生的公积金贷款最高额度超过20万。

也就是说,王先生公积金贷款可以贷213284元。

公积金贷款怎么算?

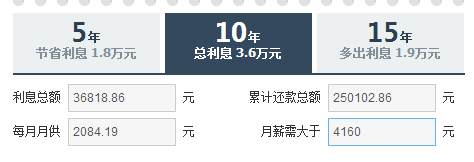

我们假设王先生房子的首付已经付掉30%,那么余下25.9万,其中的213284元可申请公积金贷款,还有4万多需要自己支付。假设王先生公积金贷款10年,采用等额本息方式还款。那么王先生每月还款2084.19元,累积还款250102.86元,利息总计36818.86元。以下是公积金贷款利率计算后王先生每月需要还款的明细。

| 期次 | 等额本息 | 等额本金 | ||||

| 偿还利息 | 偿还本金 | 剩余本金 | 偿还利息 | 每期还款 | 剩余本金 | |

|

1 |

576.88 | 1,504.54 | 211,495.46 | 576.88 | 2,351.88 | 211,225.00 |

| 2 | 572.8 | 1,508.62 | 209,986.84 | 572.07 | 2,347.07 | 209,450.00 |

| 3 | 568.71 | 1,512.70 | 208,474.14 | 567.26 | 2,342.26 | 207,675.00 |

| 4 | 564.62 | 1,516.80 | 206,957.35 | 562.45 | 2,337.45 | 205,900.00 |

| 5 | 560.51 | 1,520.91 | 205,436.44 | 557.65 | 2,332.65 | 204,125.00 |

| 6 | 556.39 | 1,525.02 | 203,911.41 | 552.84 | 2,327.84 | 202,350.00 |

| 7 | 552.26 | 1,529.16 | 202,382.26 | 548.03 | 2,323.03 | 200,575.00 |

| 8 | 548.12 | 1,533.30 | 200,848.96 | 543.22 | 2,318.22 | 198,800.00 |

| 9 | 543.97 | 1,537.45 | 199,311.51 | 538.42 | 2,313.42 | 197,025.00 |

| 10 | 539.8 | 1,541.61 | 197,769.90 | 533.61 | 2,308.61 | 195,250.00 |

| 11 | 535.63 | 1,545.79 | 196,224.11 | 528.8 | 2,303.80 | 193,475.00 |

| 12 | 531.44 | 1,549.98 | 194,674.14 | 523.99 | 2,298.99 | 191,700.00 |

| 13 | 527.24 | 1,554.17 | 193,119.96 | 519.19 | 2,294.19 | 189,925.00 |

| 14 | 523.03 | 1,558.38 | 191,561.58 | 514.38 | 2,289.38 | 188,150.00 |

| 15 | 518.81 | 1,562.60 | 189,998.98 | 509.57 | 2,284.57 | 186,375.00 |

| 16 | 514.58 | 1,566.83 | 188,432.14 | 504.77 | 2,279.77 | 184,600.00 |

| 17 | 510.34 | 1,571.08 | 186,861.07 | 499.96 | 2,274.96 | 182,825.00 |

| 18 | 506.08 | 1,575.33 | 185,285.73 | 495.15 | 2,270.15 | 181,050.00 |

| 19 | 501.82 | 1,579.60 | 183,706.13 | 490.34 | 2,265.34 | 179,275.00 |

| 20 | 497.54 | 1,583.88 | 182,122.26 | 485.54 | 2,260.54 | 177,500.00 |

| 21 | 493.25 | 1,588.17 | 180,534.09 | 480.73 | 2,255.73 | 175,725.00 |

| 22 | 488.95 | 1,592.47 | 178,941.62 | 475.92 | 2,250.92 | 173,950.00 |

| 23 | 484.63 | 1,596.78 | 177,344.84 | 471.11 | 2,246.11 | 172,175.00 |

| 24 | 480.31 | 1,601.11 | 175,743.73 | 466.31 | 2,241.31 | 170,400.00 |

| 25 | 475.97 | 1,605.44 | 174,138.29 | 461.5 | 2,236.50 | 168,625.00 |

| 26 | 471.62 | 1,609.79 | 172,528.50 | 456.69 | 2,231.69 | 166,850.00 |

| 27 | 467.26 | 1,614.15 | 170,914.35 | 451.89 | 2,226.89 | 165,075.00 |

| 28 | 462.89 | 1,618.52 | 169,295.82 | 447.08 | 2,222.08 | 163,300.00 |

| 29 | 458.51 | 1,622.91 | 167,672.92 | 442.27 | 2,217.27 | 161,525.00 |

| 30 | 454.11 | 1,627.30 | 166,045.62 | 437.46 | 2,212.46 | 159,750.00 |

| 31 | 449.71 | 1,631.71 | 164,413.91 | 432.66 | 2,207.66 | 157,975.00 |

| 32 | 445.29 | 1,636.13 | 162,777.78 | 427.85 | 2,202.85 | 156,200.00 |

| 33 | 440.86 | 1,640.56 | 161,137.22 | 423.04 | 2,198.04 | 154,425.00 |

| 34 | 436.41 | 1,645.00 | 159,492.22 | 418.23 | 2,193.23 | 152,650.00 |

| 35 | 431.96 | 1,649.46 | 157,842.76 | 413.43 | 2,188.43 | 150,875.00 |

| 36 | 427.49 | 1,653.92 | 156,188.84 | 408.62 | 2,183.62 | 149,100.00 |

| 37 | 423.01 | 1,658.40 | 154,530.43 | 403.81 | 2,178.81 | 147,325.00 |

| 38 | 418.52 | 1,662.90 | 152,867.54 | 399.01 | 2,174.01 | 145,550.00 |

| 39 | 414.02 | 1,667.40 | 151,200.14 | 394.2 | 2,169.20 | 143,775.00 |

| 40 | 409.5 | 1,671.91 | 149,528.23 | 389.39 | 2,164.39 | 142,000.00 |

| 41 | 404.97 | 1,676.44 | 147,851.78 | 384.58 | 2,159.58 | 140,225.00 |

| 42 | 400.43 | 1,680.98 | 146,170.80 | 379.78 | 2,154.78 | 138,450.00 |

| 43 | 395.88 | 1,685.54 | 144,485.26 | 374.97 | 2,149.97 | 136,675.00 |

| 44 | 391.31 | 1,690.10 | 142,795.16 | 370.16 | 2,145.16 | 134,900.00 |

| 45 | 386.74 | 1,694.68 | 141,100.48 | 365.35 | 2,140.35 | 133,125.00 |

| 46 | 382.15 | 1,699.27 | 139,401.22 | 360.55 | 2,135.55 | 131,350.00 |

| 47 | 377.54 | 1,703.87 | 137,697.34 | 355.74 | 2,130.74 | 129,575.00 |

| 48 | 372.93 | 1,708.49 | 135,988.86 | 350.93 | 2,125.93 | 127,800.00 |

| 49 | 368.3 | 1,713.11 | 134,275.75 | 346.13 | 2,121.13 | 126,025.00 |

| 50 | 363.66 | 1,717.75 | 132,558.00 | 341.32 | 2,116.32 | 124,250.00 |

| 51 | 359.01 | 1,722.40 | 130,835.59 | 336.51 | 2,111.51 | 122,475.00 |

| 52 | 354.35 | 1,727.07 | 129,108.52 | 331.7 | 2,106.70 | 120,700.00 |

| 53 | 349.67 | 1,731.75 | 127,376.78 | 326.9 | 2,101.90 | 118,925.00 |

| 54 | 344.98 | 1,736.44 | 125,640.34 | 322.09 | 2,097.09 | 117,150.00 |

| 55 | 340.28 | 1,741.14 | 123,899.20 | 317.28 | 2,092.28 | 115,375.00 |

| 56 | 335.56 | 1,745.85 | 122,153.35 | 312.47 | 2,087.47 | 113,600.00 |

| 57 | 330.83 | 1,750.58 | 120,402.76 | 307.67 | 2,082.67 | 111,825.00 |

| 58 | 326.09 | 1,755.32 | 118,647.44 | 302.86 | 2,077.86 | 110,050.00 |

| 59 | 321.34 | 1,760.08 | 116,887.36 | 298.05 | 2,073.05 | 108,275.00 |

| 60 | 316.57 | 1,764.85 | 115,122.51 | 293.24 | 2,068.24 | 106,500.00 |

| 61 | 311.79 | 1,769.63 | 113,352.89 | 288.44 | 2,063.44 | 104,725.00 |

| 62 | 307 | 1,774.42 | 111,578.47 | 283.63 | 2,058.63 | 102,950.00 |

| 63 | 302.19 | 1,779.22 | 109,799.25 | 278.82 | 2,053.82 | 101,175.00 |

| 64 | 297.37 | 1,784.04 | 108,015.20 | 274.02 | 2,049.02 | 99,400.00 |

| 65 | 292.54 | 1,788.87 | 106,226.33 | 269.21 | 2,044.21 | 97,625.00 |

| 66 | 287.7 | 1,793.72 | 104,432.61 | 264.4 | 2,039.40 | 95,850.00 |

| 67 | 282.84 | 1,798.58 | 102,634.03 | 259.59 | 2,034.59 | 94,075.00 |

| 68 | 277.97 | 1,803.45 | 100,830.59 | 254.79 | 2,029.79 | 92,300.00 |

| 69 | 273.08 | 1,808.33 | 99,022.25 | 249.98 | 2,024.98 | 90,525.00 |

| 70 | 268.19 | 1,813.23 | 97,209.02 | 245.17 | 2,020.17 | 88,750.00 |

| 71 | 263.27 | 1,818.14 | 95,390.88 | 240.36 | 2,015.36 | 86,975.00 |

| 72 | 258.35 | 1,823.07 | 93,567.82 | 235.56 | 2,010.56 | 85,200.00 |

| 73 | 253.41 | 1,828.00 | 91,739.82 | 230.75 | 2,005.75 | 83,425.00 |

| 74 | 248.46 | 1,832.95 | 89,906.86 | 225.94 | 2,000.94 | 81,650.00 |

| 75 | 243.5 | 1,837.92 | 88,068.94 | 221.14 | 1,996.14 | 79,875.00 |

| 76 | 238.52 | 1,842.90 | 86,226.05 | 216.33 | 1,991.33 | 78,100.00 |

| 77 | 233.53 | 1,847.89 | 84,378.16 | 211.52 | 1,986.52 | 76,325.00 |

| 78 | 228.52 | 1,852.89 | 82,525.27 | 206.71 | 1,981.71 | 74,550.00 |

| 79 | 223.51 | 1,857.91 | 80,667.36 | 201.91 | 1,976.91 | 72,775.00 |

| 80 | 218.47 | 1,862.94 | 78,804.42 | 197.1 | 1,972.10 | 71,000.00 |

| 81 | 213.43 | 1,867.99 | 76,936.43 | 192.29 | 1,967.29 | 69,225.00 |

| 82 | 208.37 | 1,873.05 | 75,063.39 | 187.48 | 1,962.48 | 67,450.00 |

| 83 | 203.3 | 1,878.12 | 73,185.27 | 182.68 | 1,957.68 | 65,675.00 |

| 84 | 198.21 | 1,883.21 | 71,302.07 | 177.87 | 1,952.87 | 63,900.00 |

| 85 | 193.11 | 1,888.31 | 69,413.76 | 173.06 | 1,948.06 | 62,125.00 |

| 86 | 188 | 1,893.42 | 67,520.34 | 168.26 | 1,943.26 | 60,350.00 |

| 87 | 182.87 | 1,898.55 | 65,621.79 | 163.45 | 1,938.45 | 58,575.00 |

| 88 | 177.73 | 1,903.69 | 63,718.10 | 158.64 | 1,933.64 | 56,800.00 |

| 89 | 172.57 | 1,908.85 | 61,809.26 | 153.83 | 1,928.83 | 55,025.00 |

| 90 | 167.4 | 1,914.02 | 59,895.24 | 149.03 | 1,924.03 | 53,250.00 |

| 91 | 162.22 | 1,919.20 | 57,976.04 | 144.22 | 1,919.22 | 51,475.00 |

| 92 | 157.02 | 1,924.40 | 56,051.65 | 139.41 | 1,914.41 | 49,700.00 |

| 93 | 151.81 | 1,929.61 | 54,122.04 | 134.6 | 1,909.60 | 47,925.00 |

| 94 | 146.58 | 1,934.83 | 52,187.20 | 129.8 | 1,904.80 | 46,150.00 |

| 95 | 141.34 | 1,940.07 | 50,247.13 | 124.99 | 1,899.99 | 44,375.00 |

| 96 | 136.09 | 1,945.33 | 48,301.80 | 120.18 | 1,895.18 | 42,600.00 |

| 97 | 130.82 | 1,950.60 | 46,351.20 | 115.38 | 1,890.38 | 40,825.00 |

| 98 | 125.53 | 1,955.88 | 44,395.32 | 110.57 | 1,885.57 | 39,050.00 |

| 99 | 120.24 | 1,961.18 | 42,434.14 | 105.76 | 1,880.76 | 37,275.00 |

| 100 | 114.93 | 1,966.49 | 40,467.65 | 100.95 | 1,875.95 | 35,500.00 |

| 101 | 109.6 | 1,971.82 | 38,495.84 | 96.15 | 1,871.15 | 33,725.00 |

| 102 | 104.26 | 1,977.16 | 36,518.68 | 91.34 | 1,866.34 | 31,950.00 |

| 103 | 98.9 | 1,982.51 | 34,536.17 | 86.53 | 1,861.53 | 30,175.00 |

| 104 | 93.54 | 1,987.88 | 32,548.29 | 81.72 | 1,856.72 | 28,400.00 |

| 105 | 88.15 | 1,993.26 | 30,555.03 | 76.92 | 1,851.92 | 26,625.00 |

| 106 | 82.75 | 1,998.66 | 28,556.36 | 72.11 | 1,847.11 | 24,850.00 |

| 107 | 77.34 | 2,004.08 | 26,552.29 | 67.3 | 1,842.30 | 23,075.00 |

| 108 | 71.91 | 2,009.50 | 24,542.79 | 62.49 | 1,837.49 | 21,300.00 |

| 109 | 66.47 | 2,014.95 | 22,527.84 | 57.69 | 1,832.69 | 19,525.00 |

| 110 | 61.01 | 2,020.40 | 20,507.44 | 52.88 | 1,827.88 | 17,750.00 |

| 111 | 55.54 | 2,025.87 | 18,481.56 | 48.07 | 1,823.07 | 15,975.00 |

| 112 | 50.05 | 2,031.36 | 16,450.20 | 43.27 | 1,818.27 | 14,200.00 |

| 113 | 44.55 | 2,036.86 | 14,413.34 | 38.46 | 1,813.46 | 12,425.00 |

| 114 | 39.04 | 2,042.38 | 12,370.96 | 33.65 | 1,808.65 | 10,650.00 |

| 115 | 33.5 | 2,047.91 | 10,323.05 | 28.84 | 1,803.84 | 8,875.00 |

| 116 | 27.96 | 2,053.46 | 8,269.59 | 24.04 | 1,799.04 | 7,100.00 |

| 117 | 22.4 | 2,059.02 | 6,210.58 | 19.23 | 1,794.23 | 5,325.00 |

| 118 | 16.82 | 2,064.60 | 4,145.98 | 14.42 | 1,789.42 | 3,550.00 |

| 119 | 11.23 | 2,070.19 | 2,075.79 | 9.61 | 1,784.61 | 1,775.00 |

| 120 | 5.62 | 2,075.79 | 0 | 4.81 | 1,779.81 |

0 |

上一篇:试用期公积金怎么算?

下一篇:安徽住房公积金缴存比例是多少呢?